Global Capital Markets and Infrastructure

"Our investment vehicles and strategies leverage our extensive operations, our global network of relationships and our deep due diligence experience."

"Our investment vehicles and strategies leverage our extensive operations, our global network of relationships and our deep due diligence experience."

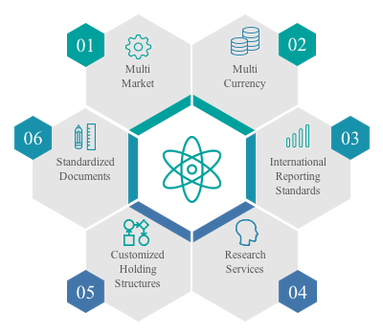

Cleartrust uses customized external asset services bringing together a range of administrative and expert capabilities that enhance our operations.

We work with portfolio strategies grounded on strategic asset allocation and supplement our investment views by having expert advise on particular asset classes and geographies.

We work collaboratively to ensure a high quality of asset servicing so that the unique requirements for each of our strategies are fully met. Our teams work closely together, developing clear goals and actionable strategies to achieve our targets, periodically monitoring investments and providing adequate risk management.

The right people and counterparts

Appropriate infrastructure

Innovative vision and strong values

Solid strategies

Disciplined execution

Our team has access to a broad spectrum of asset classes and investment specialists located in multiple geographic areas. Our goal is to develop customized solutions, using our infrastructure and in-depth network of contacts to ensure best pricing and liquidity while remaining able to explore available alternatives for best execution.

Our product range reach and geographical spread includes European, Asian, US, and Latin American securities:

Fixed Income

High Yield, Corporate, Emerging Markets,

Government Debt

Equities

Derivatives

Structured Products

Cash

Money Market Instruments

FX

ETFs

Funds

Our global custodial relationships provide us full access to a network of sub-custodians. We have the highest care of our securities safekeeping, settlement, corporate actions and income collection.

Through our independent custody and depositary relationships we have access to a full range of solutions, including safekeeping and monitoring for alternative asset funds. We have our assets overseen in full accordance with regulations, and integrate the depositary function with the rest of our activities.